Understanding Tax Deductions: How the Standard Deduction Simplifies Filing

I’m glad I learned about parallelograms in high school math. It comes in so handy during parallelogram season.

Jokes aside, tax season can feel a bit like parallelogram season for many of us—complex shapes, angles, and all! But here’s the good news: the IRS offers ways to simplify your tax filing with deductions that can lower your taxable income.

According to the IRS, close to 90% of taxpayers now take the standard deduction. So, let’s dive into what deductions are, the difference between the standard and itemized deduction, and why most people—especially young folks—opt for the standard deduction.

What Are Tax Deductions?

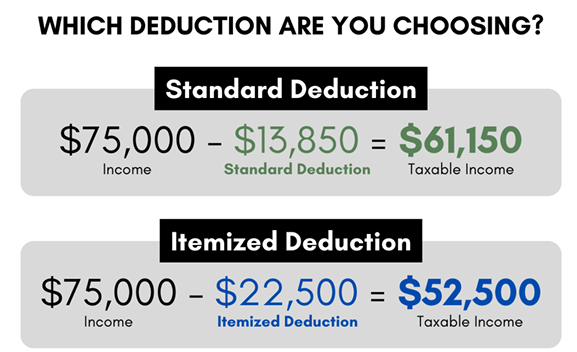

Taxes?! Give us some background, but go heavy on the good news! Well, the bright side is, you don’t have to pay taxes on all your earnings. The IRS allows you to deduct a certain amount from your income before calculating the taxes you owe. This reduction in taxable income is what makes deductions so valuable to your personal finance education.

There are two types of tax deductions:

The Standard Deduction

This is a specific dollar amount set by the government that you can subtract from your income without needing to list all your expenses. It’s the easiest option, which is why most young taxpayers and those new to financial literacy for beginners prefer it.Itemized Deductions

Instead of taking the standard deduction, you can subtract the sum of all your eligible expenses (like mortgage interest, charitable donations, or medical bills) from your income. Itemizing can be more complicated, which is why it’s often reserved for those with significant deductions.

Why Do Most People Choose the Standard Deduction?

In 2023, the standard deduction was $13,850 for single taxpayers—a 7% increase from 2022. That means if your Adjusted Gross Income (AGI) was $50,000, you can subtract $13,850 from that amount, leaving you with $36,150 in taxable income. This simple subtraction lowers the income on which you’ll be taxed, which is a win for your wallet.

Most young people or those without many eligible expenses opt for the standard deduction. It’s a straightforward way to lower your taxable income without needing to keep track of various receipts. Plus, simplicity is key when you’re just getting started with financial literacy education.

Dive Deeper: Want to Learn More?

Want to become a tax pro? Check out Link & Learn Taxes, an IRS free, self-paced online course that teaches you how to accurately prepare income tax returns for individuals. Pass the certification test, and you’ll even be eligible to help others file their taxes as a VITA/TCE volunteer—a great way to give back while improving your personal financial literacy!

Fun Fact:

In case you didn’t know, tax deductions can make a significant difference in your overall tax bill. By learning how to use them effectively, you’re already on your way to boosting your financial wellness.

Questions, thoughts, or curious about another topic? Email us at casey@your-orchard.com!