Learn this while you are young: The Rule of 72

The Rule of 72 is a classic rule of thumb in personal finance that every young person should know. It’s a simple way to estimate how long it will take to double your investment at a fixed annual rate of return. Understanding this concept early can have a huge impact on your financial wealth down the road.

What Is the Rule of 72?

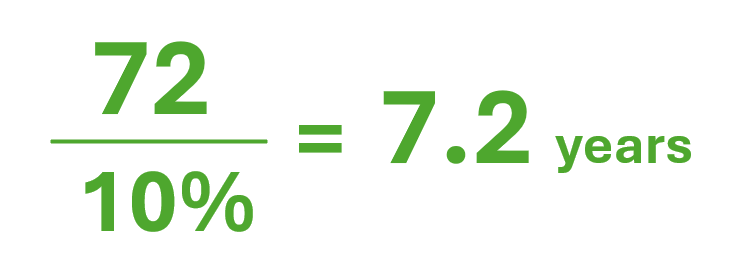

To calculate the Rule of 72, you divide 72 by your annual rate of return. The result tells you the number of years it will take to double your investment.

Let’s break it down with an example: If you’re earning a 10% return on your investment, you divide 72 by 10. The answer is 7.2, meaning it would take approximately 7 years to double your money at that return rate.

This simple rule can be applied to a variety of investments, from index funds to more conservative options like high-yield savings accounts.

Example: Starting at Age 20

Let’s say you start with $10,000 at 20 years old. If you consistently earn a 10% return on your investment, the Rule of 72 shows your money would double roughly every 7 years. Here’s how it might play out:

By age 27, your $10,000 becomes $20,000.

By age 34, it doubles again to $40,000.

By age 41, it reaches $80,000.

By age 48, your investment hits $160,000.

By age 55, it grows to $320,000.

By age 62, you’re looking at $640,000.

By age 69, your initial $10,000 has grown into $1.28 million!

This highlights the incredible power of compounding and the importance of starting early to grow your financial wealth.

Four Key Concepts of Compounding

1. The Earlier You Start, The Better

Compounding works like an upside-down triangle. It may start off slow, but with each successive doubling, your wealth grows exponentially. The early doubles may not seem impressive, but they’re the stepping stones to the big growth you’ll see later on. This is why financial literacy for beginners should always emphasize the importance of starting as soon as possible.

2. Return Matters

A 10% return is great and makes the Rule of 72 easy to apply, but what if your return is lower? If you decide to leave your money in a high-yield savings account earning 3% interest, the math changes.

72 divided by 3% equals 24 years—meaning it would take 24 years to double your money. In the earlier example, reaching $1.28 million would take you 192 years instead of 49 years! The lesson? To grow your financial wealth, you need to take some calculated risks to achieve higher returns. A savings account won’t cut it.

3. Risk vs. Reward

While chasing higher returns can accelerate your wealth-building, it also comes with higher risks. If you invest in something promising returns above 10%, be cautious. Higher returns often mean higher risks, and if the investment fails, your upside-down triangle of wealth could collapse. This is why personal financial literacy teaches you to be wary of promises that seem too good to be true.

4. Save More, Start Early

The more you invest upfront, the bigger your upside-down triangle grows over time. Every dollar you invest today has the potential to multiply through compounding. Starting early and saving more not only gives your money more time to grow, but it also puts you in control of your financial future.

Picture each dollar you save as its own upside-down triangle, growing and expanding with time. The longer you keep those dollars invested, the wider the base of the triangle becomes. This is the core of building personal financial literacy and growing financial wellness.

Start Building Your Financial Future Today

Learning and applying the Rule of 72 while you’re young is one of the simplest yet most effective ways to grow your financial wealth. Whether you're investing in low-cost index funds or saving in a high-yield savings account, understanding compounding and starting early can make all the difference.

For more tips on how to build your financial future, check out www.your-orchard.com for our mission, philosophy, and archived newsletters.

Got questions or curious about another topic?

Email us at casey@your-orchard.com! We’re here to help you on your financial literacy education journey.