Afraid to Invest in Stocks? Here's Why Patience and Strategy Matter

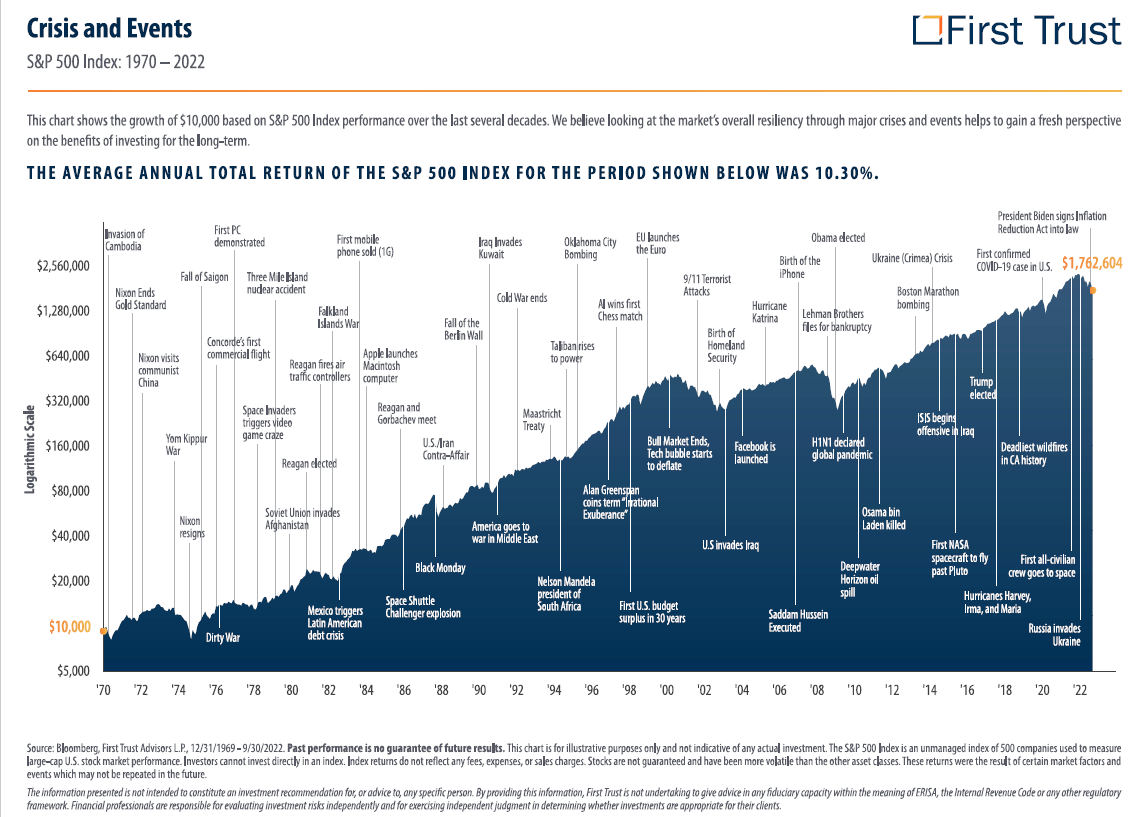

It’s completely normal to be afraid of investing in stocks—especially when the market fluctuates. But here’s the thing: the market will go down. It’s inevitable. The good news? It will also go up. No one can predict what the future holds exactly, but if you’ve got time on your side (10-20+ years), investing in diverse and low-fee assets can still be one of the most profitable ways to grow your financial wealth in the long term.

As Winston Churchill wisely said, “The farther backward you can look, the farther forward you are likely to see.” History is a strong indicator that the stock market, while volatile, tends to trend upward over time. This is a key point in any financial literacy education, as understanding market patterns can help you overcome your fear of short-term losses.

Why You Shouldn’t Fear a Market Downturn

The 20th century was filled with countless challenges for the U.S. economy. The country faced two world wars, the Great Depression, multiple recessions, oil crises, and even the resignation of a disgraced president. Despite all this turmoil, the Dow Jones Industrial Average rose from just 66 to an impressive 11,497 by the end of the century. Let that sink in for a moment—through every downturn and crisis, the stock market still managed to recover and grow.

Warren Buffett, one of the world’s most successful investors, sums it up perfectly: “The stock market is a device for transferring money from the impatient to the patient.” In fact, if you look at data going back to 1872, there has never been a 20-year period in the U.S. stock market where you would have lost money. The key, though, is patience, staying invested for the long haul, and maintaining a diversified portfolio.

This is why personal finance education should emphasize the importance of long-term investment strategies. Fear of short-term losses often prevents people from making sound financial decisions, but learning how to navigate market fluctuations is part of building personal financial literacy.

How and Where to Invest

If you’re just starting out or want a low-risk, diversified investment, consider VTSAX (Vanguard Total Stock Market Index Fund). It has a very low expense ratio of 0.04%, and it holds around 3,700 stocks. This gives you exposure to the entire U.S. stock market, minimizing risk through diversification—a principle often highlighted in financial wellness coaching and financial literacy programs.

Why is VTSAX a smart choice?

Low-fee? Check. Managing fees is essential for long-term success and a major factor discussed in any solid financial consulting services.

Diverse? Check. A well-diversified portfolio ensures that you’re spreading risk across a range of companies, sectors, and industries.

By choosing such diversified, low-fee investments, you're setting yourself up for financial stability. This approach is critical for anyone learning financial literacy or those looking for personal financial advisors to guide them through their investment journey.

The Best Way to Build Wealth? Be Patient.

If you're still on the fence, consider this: the stock market rewards those who can wait. Wealth management advisors and experts in financial wellness programs often stress the importance of riding out the market’s ups and downs. Long-term investors consistently benefit from the market’s overall growth.

Conclusion

The stock market can be intimidating, but with the right strategy—focusing on diversification, low fees, and patience—you can overcome your fear of market downturns. Building financial literacy for beginners involves understanding that while short-term dips are part of the process, the long-term potential for growth is where the real opportunity lies.

Ready to dive into the world of investing? Remember, the earlier you start, the better. By embracing personal finance education and keeping your eyes on the long-term horizon, you’ll be well on your way to growing your wealth over time.

Have questions or want to explore more financial topics? Email us at casey@your-orchard.com!